The Chart of Accounts is method of organizing business financial information. Assets, Liabilities, Equity, Income and Expenses are summarized to present a concise overview of your financial situation.

An Income Statement (also called a Profit & Loss report) uses the chart of accounts to summarize your business’s sales and expenses to show profitability. The income statement is one of the Financial Reports that the Jewelry Shopkeeper produces. See Reading the Income Statement on page for more details.

The Balance Sheet summarizes your business’s assets and liabilities to present the business’ tangible net worth. See Reading the Balance Sheet on page for more details.

The chart of accounts stores month-end balances for each account for the previous twenty-four months so you can quickly see current as well as past financial information.

Note that accounts numbers can be up to nine digits long, even though three digits are shown below. For example where 100–199 is shown, you can substitute 10000–19999 or 100000000–199999999 depending on the account number system you prefer.

The Jewelry Shopkeeper follows accounting standards by grouping accounts according to the following convention:

100–199: Assets (accounts beginning with 1)*} Assets such as Inventory, Accounts Receivable and Property have accounts beginning with 1.

200–299: Liabilities (accounts beginning with 2)*} Liabilities such as Accounts Payable, Taxes Due, Loans Due.

300–399: Equity (accounts beginning with 2)*} Equity is your net worth

400–499: Income (accounts beginning with 2)*} Sales receipts

500–599: Cost of Goods Expense (accounts beginning with 2)*} Expenses for merchandise or for repair work if you sub-contract repairs.

600–999: Operating Expenses (accounts beginning with 2)*} Any expense Excluding: payments for merchandise (i.e. 500–599 expenses); repayment of loan principal, payment of taxes due. The last two would normally be posted to a liability account (200–299) to reduce the liability.

Operating Expenses may be considered expenses at the time they are incurred or when they are paid but not both. For example, you can post the tax portion of wages as an expense when the wages are paid (even though you have not actually paid the taxes), but when you pay the taxes at a later date, you cannot post them as expenses then, since that would constitute double-counting. Instead, you would post it to the tax liability account to reduce that liability.

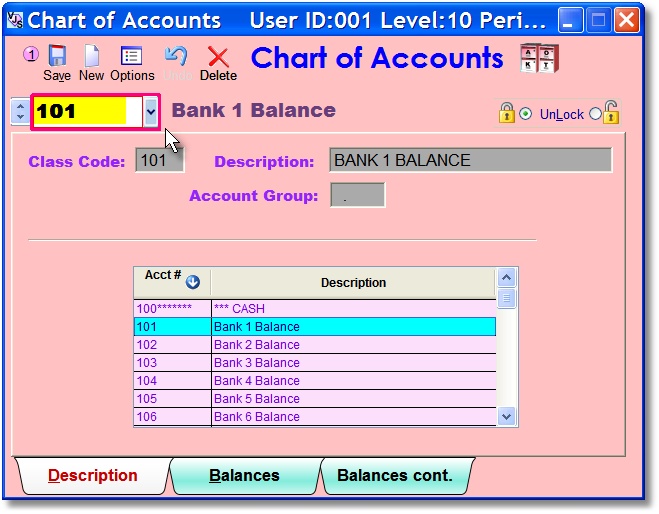

The Jewelry Shopkeeper is shipped with a comprehensive chart of accounts already filled-in, and it contains most of the accounts that you are likely to need. However, if you have your own chart of accounts you can enter it from the Chart Of Accounts Maintenance Menu. If you do make changes, be sure to follow the account numbering convention above and see the Chart of Accounts Defaults section below.