Instructions for Changing the Sales Tax Rate(s)

If your sales tax rate changes, first change it in Preferences from the VJS Maintenance Menu - Open General then Sales Tax on the left.

Returns

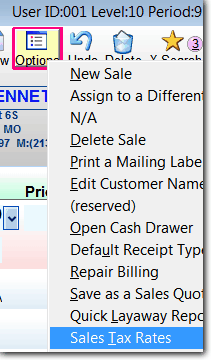

If you accept returns at the old rate you'll have to manually change the tax rate on those individual sales tickets. To do this, record the sale and put the returned Sku number on line 1 (with a minus-one quantity as is normal for returns). Then choose Options (at the top) and then Sales Tax rate.

* Note 1. This changes the tax rate for the entire ticket so for an exchange You must process the return item on one sales ticket at the old rate and issue a credit slip or cash refund. Then process the new item on another sales ticket at the regular new rate.

* Note 2. To help you identify such old-rate returns give the return a special DEPT code (under the date and clerk) so you can run a itemized sales report where you select just that DEPT code.

Old Pending Layaways ..................--

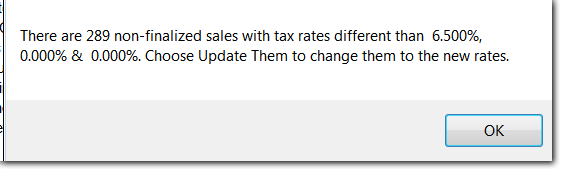

Another aspect of changing sales tax is that pending, (non finalized) layaways, special-orders and repairs have already been stamped with the previous tax rate.

If you retrieve a pending sale with the old tax rate, you will see a warning ! in the subtotal

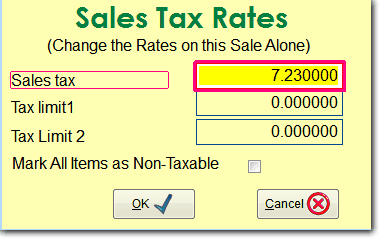

and you can choose Options (at the top) and then Sales Tax rate.

...

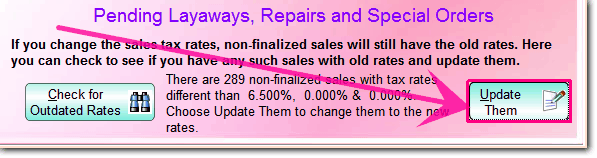

A new option allows you to easily update, in bulk, all any pending (non-finalized) layaways with the new tax rate.

From the Sales Tax page of Preferences, enter the new sales tax rate. This applies to new sales, not pre-existing sales.

Then click on "Check for Outdated Rates" which will tell you if there are pending sales with the old rate.

To update those pending sales with the new rate, choose "Update Them"

When you process a return of an item sold in a previous month with the prior rate, it's possible that you should apply the old rate. This would depend on the instructions for your sales tax return forms.

You can override the tax rates on any sale, including return sales by choosing Options, Sales Tax Rates.

If you do that, you might want to assign such sales with a special DEPT code so you can isolate them for special handling for sales tax returns.

I.e. you can run the Itemized Sales Reports for a specific DEPT code or excluding that DEPT code.

It becomes even more complicated for an exchange. A single sales ticket in Shopkeeper has one sales tax rate so the return item can't be accepted at, say, 9% with the newly sold item going out with a 10% rate.

This might be more trouble than it's worth, so you might just handle all returns and exchanges at the current rate, unless you are processing extremely high-ticket items.