Explanation of the Summary Area of the Sales Payment Spreadsheet

Depositable receipts will rarely match the sales total because of layaways initiated (more money received than reportable sales); or paid off (more reportable sales than money received); or credit slips or gift certificates issued or used, or in-house accounts receivable sales.

At the bottom of the Sales Payment Spreadsheet Report there are various numbers. They can't be added up to get the total as they may have overlap. This report is not to be used for accounting, but for a review of the day's activity.

The totals which can be summed up from the lines above are in the totals line - such as Cash, Subtotal, etc.

*) Special orders = Value of sales flagged special orders

*) Memo = Value of ITEMS flagged as memo

(there might be an overlap if you have a memo item on

special order sale however, that would be balanced by

a reduction in Other Sales)

*) Other Sales = Whatever portion is NOT any of charge, special, memo, layaway, out of state, resale, repairs, labor.

It's a forced balance account and could be negative in cases where there is overlap in

some of the other sales subtotals.

*) Resale = Sales to customers marked with either a Wholesale level,

Tax Exempt or a Resale Number [and if the sale had no tax]

*) No Tax Services (Formerly: Labor)

= Value of Sku items from major class codes of type 1 or 2 or 3 (Repair or Custom Work or Appraisal)

for non-taxable items

There could be some overlap with the Repairs total.

(This total is not applicable if there is no state sales tax for all sales.)

*) All Services (Formerly: Repair)

= Value of Sku items from major class codes of type 1 or 2 or 3 (repair or custom work or appraisal )

for both taxable and non-taxable items.

There could be some overlap with the Labor total.

(This total is not applicable if there is no state sales tax for all sales.)

*) Layaway = Finalized layaway / repair sales

There could be an overlap with repairs/labor

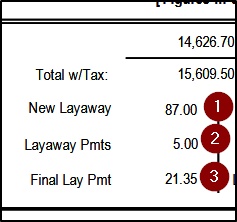

*) The three layaway total lines on the left are for layaway payments:

1) for layaway deposits on newly initiated layaways

2) for payments on prior layaways, but not paid off today

3) layaway payments that closed out layaways today.

*) Non-tax merch would be items that were not taxable but in a major code that is neither a repair or service category.

You could run an itemized sales report for non-taxable items to report more details behind that.

---

The repair box is added to for items where the Repair category (on the major code screen ) is set to 1 (std repairs) or 2 (extended repairs)

The labor box is added to for items where there is NO tax and where the Repair category (on the major code screen ) is set to 1 (std repairs)

or 2 (extended repairs) i.e. it appears there's an overlap and the labor box value is included in the repair box value - but it's only the non-taxable portion.

*) Customer Liab Increase is the increase in the total of pending deposits you have from your customers.

It is calculated as the total depositable money received minus total sales including tax. A positive number means you have increased your liabilities; a negative number means you have decreased your customer liabilities.

I.e. if you receive $100 on a pending layaway, that's $0 in sales and, you are holding more of the

customers' money and have increased your liability by $100.

If you receive the final $200 of a $700 special order, you book $700 of sales, but the previous $500

deposit is no longer liability so you have reduced your liabilities by $500.

If you book a $300 sale paid for with a credit slip, you have lowered your liabilities to customers.

If you issue a credit slip or a gift certificate, you have increased your liabilities to customers.