Partially Using Credit Slips and Gift Certificates

Here's the procedure for partially using a credit slip / gift certificate and leaving the balance available for future use.

Record the new sale:

and select Credit Slip / Gift Certificate as the payment type.

Select the credit slip from the list (or type the number if the slip was issued in someone else's name.)

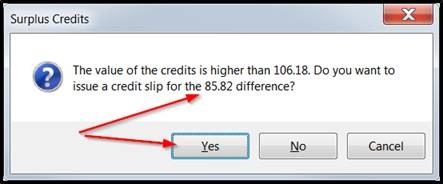

If the slip has a value higher than the payment amount, you will be asked if you want to issue a credit slip for the remaining balance.

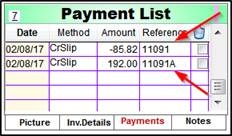

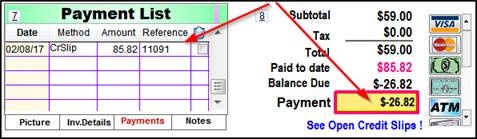

The payment area of the sale will show the entire amount being used as a positive payment and the negative payment reflects the remaining balance being put on the slip. Note that the portion which was used has a suffix - typically A, and the remaining credit retains the original number and is available for future use.

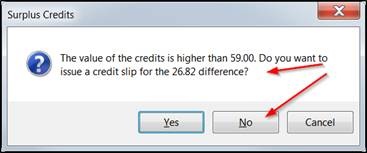

You can choose *not* to give back the difference in value

as a credit slip

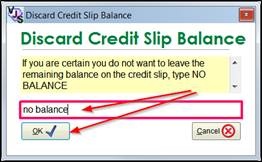

Because that's unusual, you will be prompted to verify your intention

The sale will then prompt for how the balance will be refunded to the customer -e.g. as Cash.

If you don't intend to refund the balance - perhaps in the case of a promotional credit slip, the sale still has to be balanced so you might choose to create the refund credit slip and then cancel it afterwards.

Or you might choose to create a new "payment" method for such cases so you'd have a record of such activity in the cash register reports.